Have you ever stopped to think about the sheer financial power behind some of the world's most beloved chocolate bars? It's a question many folks ponder, especially when you're munching on an M&M's, a Snickers, or a Twix. We are, of course, talking about Mars, Inc., a company that's truly a giant in the snack world, and figuring out its exact financial standing, or what some call its "net worth," can be a bit of a puzzle, you know?

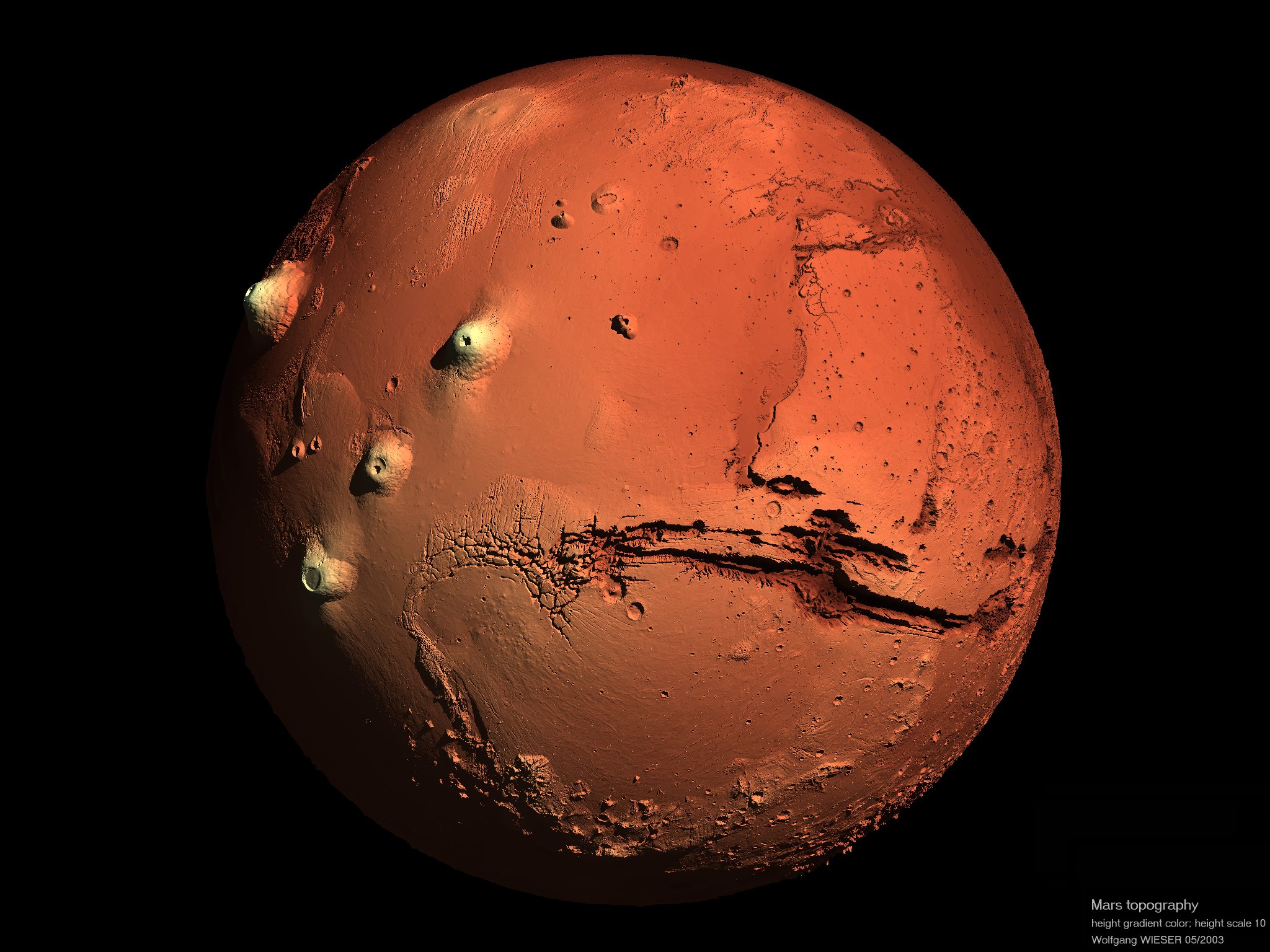

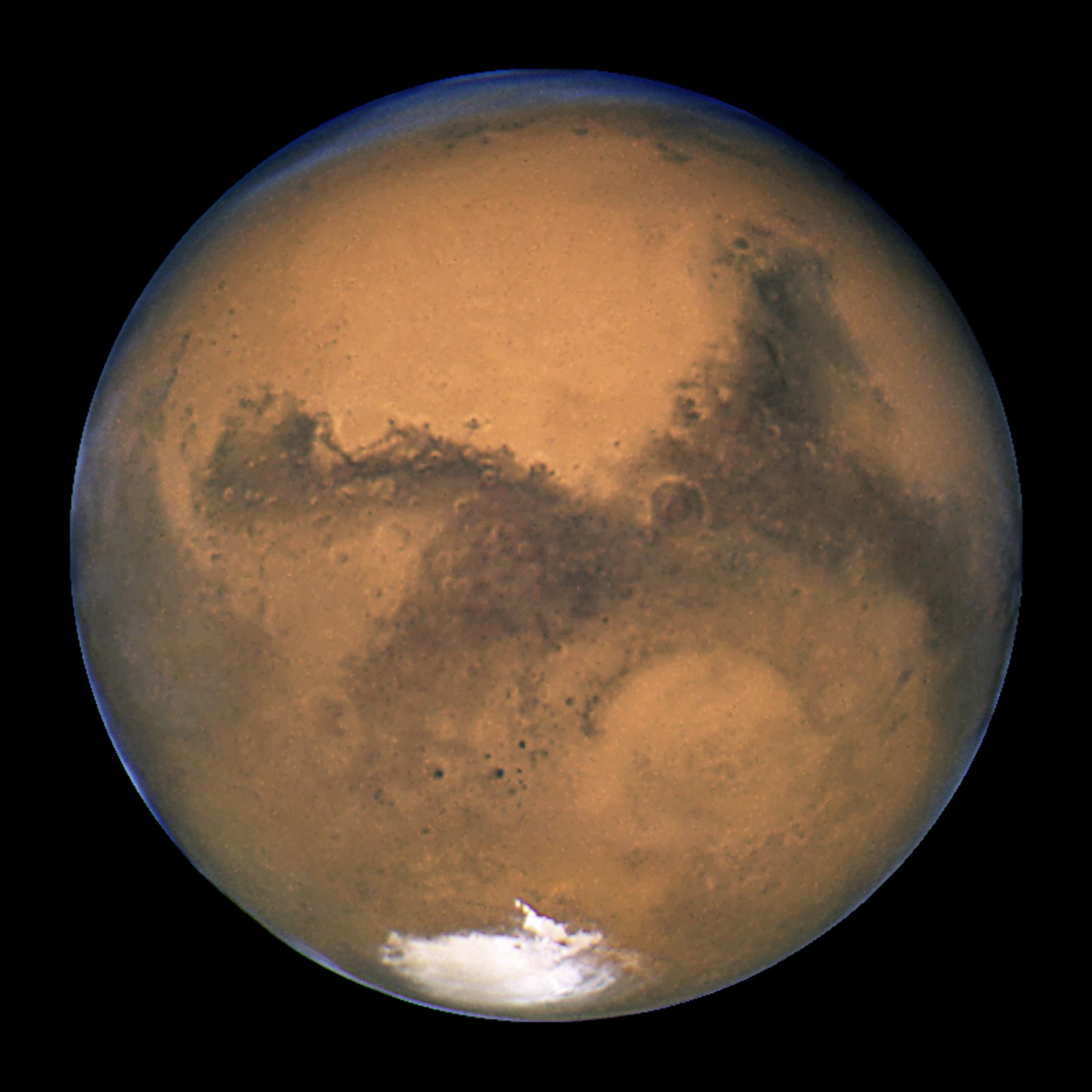

Now, before we get into the delicious details, it's important to clear something up. The information you gave me, which was about probes on Mars, its seasons, its rusty red surface, and even NASA's Perseverance rover capturing breathtaking video footage, is actually about the planet Mars. While that's fascinating stuff, and it tells a story of a dynamic planet, it doesn't really connect to the financial figures or the business operations of Mars, Inc., the chocolate company. So, we'll be looking at the company's financial story based on publicly available information about businesses, rather than information about the red planet.

So, what we're going to do here is take a closer look at this privately held powerhouse. We'll explore how its vast array of products, from chocolate to pet care, contributes to its overall financial picture. It's a really interesting topic, especially since this company doesn't share all its numbers like public companies do, but we can still get a pretty good sense of its immense value, you know?

Table of Contents

- Mars, Inc.: A Look at the Company Behind the Chocolate

- How Do You Gauge a Private Company's Worth?

- Revenue and Market Impact: Signs of a Big Business

- Beyond the Bars: A Diverse Business

- Global Reach and Brand Power

- The Secret Sauce of Private Ownership

- Future Outlook and Innovation

- Frequently Asked Questions About Mars, Inc.'s Financials

- Wrapping Up: The Enduring Value of Mars

Mars, Inc.: A Look at the Company Behind the Chocolate

Mars, Inc. isn't just a chocolate maker; it's a truly global consumer goods giant. It's a family-owned business, which is a pretty unique thing for a company of this size, you know? This private ownership means they don't have to answer to shareholders in the same way public companies do, allowing them to make long-term decisions without constant pressure from the stock market. This structure, in a way, has helped them grow steadily over many, many years.

The company started way back in 1911, and it has certainly grown from those early days. They've expanded their reach far beyond just candy. While chocolate bars like Snickers and M&M's are what many people think of first, Mars also owns a very big pet care business with brands like Pedigree and Whiskas, and a food segment with brands like Uncle Ben's. This broad portfolio, you see, helps them stay strong even when one part of the market might be a little slow.

Key Facts About Mars, Inc.

| Detail | Information |

|---|---|

| Founded | 1911 |

| Founders | Frank C. Mars |

| Headquarters | McLean, Virginia, USA |

| Ownership | Privately held, family-owned |

| Key Business Segments | Confectionery, Petcare, Food |

| Notable Chocolate Brands | M&M's, Snickers, Twix, Mars Bar, Milky Way, Dove |

| Notable Petcare Brands | Pedigree, Whiskas, Royal Canin, Banfield Pet Hospital |

| Notable Food Brands | Ben's Original (formerly Uncle Ben's), Dolmio, Masterfoods |

How Do You Gauge a Private Company's Worth?

Figuring out the exact "net worth" of a private company like Mars, Inc. is a bit different from looking up a public company's stock market value. Public companies have shares traded openly, and their market capitalization gives a clear picture of their worth. For a private company, that kind of number just isn't out there for everyone to see, you know? They keep their financial statements very close to the vest, which is their right.

So, instead of a precise net worth, analysts and business watchers often look at other things. They consider the company's annual revenue, which is how much money they bring in from sales. They also look at their assets, like factories, brands, and cash, and subtract their liabilities, such as debts. Sometimes, they'll estimate a valuation based on what similar public companies are worth or on recent acquisitions in the industry. It's more of an educated guess than a definite figure, you see, but it still gives a pretty good idea of their financial scale.

For a company like Mars, which has been around for over a century and owns so many well-known brands, its worth is certainly in the many billions. It's not just about the chocolate, either; the pet care division alone is a massive business, contributing a very significant portion to their overall income. This diversity makes them incredibly resilient, which is a big part of their overall value, you know?

Revenue and Market Impact: Signs of a Big Business

While Mars, Inc. doesn't publish its net worth, it does often report its annual revenue, which gives us a solid clue about its size. In recent years, Mars, Inc. has consistently reported annual revenues that place it among the largest privately held companies in the world. We're talking about figures that are often in the tens of billions of dollars each year, which is a truly huge amount of money, you know?

This massive revenue stream comes from its diverse operations across confectionery, pet care, and food. The sheer volume of products they sell globally, from a small bag of M&M's to a large bag of pet food, adds up very quickly. This kind of financial performance shows just how much impact they have on the global economy and how many people around the world buy and use their products every single day. It's a real testament to their widespread appeal.

Their market impact is also clear in their ability to acquire other companies and invest in new technologies. When a company can buy up other big names or pour money into research and development, it's a strong sign of financial health and long-term planning. This steady growth and expansion, without the need for public funding, suggests a very robust financial foundation. It's a pretty impressive feat, honestly, for a company that started with just a simple candy bar.

Beyond the Bars: A Diverse Business

It's very easy to think of Mars, Inc. only in terms of chocolate, but that would be missing a very big part of their story. Their pet care segment, for example, is actually larger than their chocolate business in terms of revenue. Brands like Pedigree, Whiskas, Royal Canin, and even a large chain of veterinary hospitals, Banfield Pet Hospital, fall under the Mars umbrella. This part of the business has seen incredible growth as more and more people treat their pets like family members, which is a big trend right now, you know?

Then there's the food segment, which includes well-known names like Ben's Original rice and Dolmio sauces. While perhaps not as flashy as chocolate or pet care, these brands are staples in many kitchens around the world. Having these three distinct pillars—confectionery, pet care, and food—means that Mars, Inc. isn't putting all its eggs in one basket. If one market slows down, the others can help pick up the slack, making the company very stable and strong financially. It's a smart business strategy, that's for sure.

This diversification means that when we talk about "Mars chocolate net worth," we're really talking about the financial strength of a much broader enterprise. The success of their pet care and food divisions contributes significantly to the overall value and stability of the entire Mars, Inc. corporation. It's all connected, you see, and each part supports the others, making the whole entity more valuable than just the sum of its chocolate parts.

Global Reach and Brand Power

Mars, Inc. is truly a global player, operating in nearly every country around the world. Their brands are recognized and loved by billions of people, which is a huge asset in itself. Think about it: an M&M's is an M&M's whether you're in New York, London, or Tokyo. This consistent brand recognition and global distribution network are incredibly valuable, arguably more so than just the physical assets they own, you know?

The power of their brands means that consumers trust their products, and they're willing to buy them again and again. This loyalty translates into consistent sales and strong revenue streams. Building this kind of brand equity takes decades of consistent quality and smart marketing, and Mars has certainly done that. It's not something you can just buy overnight; it's built over a very long time, and that's a big part of their enduring financial strength.

Their presence in emerging markets also positions them for future growth. As economies in different parts of the world develop, more people gain disposable income, and often, one of the first things they spend it on are treats and pet products. Mars is already there, ready to meet that demand. This forward-thinking approach to global expansion is a key factor in their continued financial success and contributes significantly to their overall estimated worth, that's for sure.

The Secret Sauce of Private Ownership

One of the most unique aspects of Mars, Inc.'s financial story is its private ownership. Unlike publicly traded companies that face constant scrutiny from investors and quarterly earnings calls, Mars can afford to think very long-term. This means they can invest in projects that might not show immediate returns but could be very beneficial years down the line. It's a rather different way of doing business, you know?

This approach allows them to focus on sustainability, employee well-being, and brand building without the pressure of meeting short-term financial targets. For example, they can invest heavily in sustainable cocoa farming practices or in pet welfare initiatives, knowing that these efforts will strengthen their business in the long run, even if they don't boost profits next quarter. This kind of strategic freedom is a very valuable asset in itself.

The family's commitment to keeping the company private also speaks volumes about their confidence in its enduring value. They believe in the business enough to retain full control, rather than cashing out through a public offering. This stability and consistent vision, free from external shareholder demands, is a significant factor in their sustained growth and financial health, making them a very unique player in the global market, you know?

Future Outlook and Innovation

Looking ahead, Mars, Inc. continues to innovate and adapt to changing consumer preferences. They are investing in healthier snack options, plant-based foods, and sustainable packaging. For instance, you might see new types of chocolate bars with less sugar, or more environmentally friendly packaging for their pet food. These innovations are crucial for staying relevant in a fast-changing market, you know?

They are also very active in digital transformation, using data and technology to improve their operations and reach consumers more effectively. From online sales to personalized marketing, Mars is embracing the digital age to ensure their brands remain popular and accessible. This forward-thinking approach helps them maintain their competitive edge and continue to grow their revenue streams.

The company's commitment to research and development, particularly in areas like pet nutrition and sustainable agriculture, also points to a strong future. By staying at the forefront of these fields, they ensure their products remain high-quality and relevant to consumers' evolving needs. This ongoing investment in their future, arguably, is a key component of their long-term value and sustained financial success, that's for sure.

Frequently Asked Questions About Mars, Inc.'s Financials

Here are some common questions people ask about the financial standing of Mars, Inc.:

1. Why is it hard to find the exact "net worth" of Mars, Inc.?

Well, it's difficult because Mars, Inc. is a privately owned company, which means its shares aren't traded on public stock exchanges. Unlike public companies, they aren't required to disclose their full financial details, like net worth, to the public. They do often report their annual revenue, which gives a good indication of their massive scale, but the exact "net worth" figure remains private, you know?

2. Is Mars, Inc. bigger than just chocolate?

Absolutely! While their chocolate brands like M&M's and Snickers are incredibly famous, Mars, Inc. is a much larger and more diverse company. They have a huge pet care segment with brands like Pedigree and Whiskas, and also a significant food business with products like Ben's Original rice. In fact, their pet care division often generates more revenue than their chocolate sales, which is pretty interesting, you know?

3. How does Mars, Inc.'s private ownership affect its business decisions?

Private ownership gives Mars, Inc. a lot of freedom. They don't have to worry about pleasing public shareholders or hitting quarterly earnings targets, so they can focus on very long-term strategies. This means they can invest in things like sustainability, new technologies, or employee programs that might take years to show a return, but ultimately strengthen the company's foundation. It allows for a more stable and strategic approach to growth, you see.

Wrapping Up: The Enduring Value of Mars

So, while pinpointing an exact "net worth" for Mars, Inc. is a challenge due to its private status, it's very clear that this company is a truly immense financial force. Its consistent multi-billion dollar revenues, vast portfolio of beloved brands across confectionery, pet care, and food, and its deep global reach all point to an enterprise of staggering value. The enduring appeal of its products, from a simple chocolate bar to essential pet food, means it touches countless lives every single day.

The company's long history, its family ownership, and its strategic investments in the future all contribute to its very strong financial standing. It's a testament to how a well-managed, diversified business can thrive for over a century, even without the public spotlight. To learn more about business trends on our site, and you can also link to this page here for further insights into global companies. For more details on the company's operations, you could always check a reputable business news site for their reported revenues, that's for sure.

Detail Author:

- Name : Penelope Legros

- Username : okuneva.estrella

- Email : jamie.mayer@hotmail.com

- Birthdate : 1982-10-22

- Address : 4640 Tillman Land East Katlynn, SD 75914

- Phone : (212) 705-7753

- Company : Labadie-Brekke

- Job : Procurement Clerk

- Bio : Quisquam voluptatem labore voluptatum quaerat aut. Quibusdam aliquam quibusdam occaecati. Est est ad quo asperiores excepturi.

Socials

tiktok:

- url : https://tiktok.com/@yesenia_cole

- username : yesenia_cole

- bio : Nam libero eveniet nesciunt eum dignissimos.

- followers : 797

- following : 2519

twitter:

- url : https://twitter.com/cole2015

- username : cole2015

- bio : Vel ut natus omnis suscipit omnis est. Unde doloremque facilis delectus. Quas molestias eos omnis natus.

- followers : 3558

- following : 2874

linkedin:

- url : https://linkedin.com/in/yesenia412

- username : yesenia412

- bio : Occaecati excepturi nesciunt ut praesentium nisi.

- followers : 4240

- following : 247

facebook:

- url : https://facebook.com/yeseniacole

- username : yeseniacole

- bio : Rerum quia aperiam corrupti sunt aliquid.

- followers : 2581

- following : 1626

instagram:

- url : https://instagram.com/yesenia7255

- username : yesenia7255

- bio : Ut cum sed non veritatis. A delectus sit veritatis eos explicabo dignissimos.

- followers : 1130

- following : 439