Have you ever come across the phrase "brent corrigan brent" and wondered what it actually means, especially when you are looking for information about global energy markets? Well, you know, sometimes search queries can be a little bit unique, and it seems like "brent corrigan brent" might actually be pointing us towards something really important in the world of oil. It's almost as if it's a way people might be trying to find out about Brent Crude Oil, which is a big deal for everyone who follows energy prices around the globe. We are going to talk about that here.

So, you see, understanding what influences the cost of oil is pretty much a big deal for, like, pretty much everyone. It affects so many things, from the price you pay at the pump to the cost of goods shipped across oceans. This particular kind of oil, Brent Crude, is a major player, a kind of main reference point for oil deals all over. Knowing a little about it, you know, can really help make sense of daily news about energy. This article will help you get a better handle on what Brent Crude is all about, and why it matters so much.

We will get into how its cost is figured out, what makes it a global benchmark, and even, like, what the experts are saying about its future cost. It's really quite fascinating, actually, how this one type of oil, sourced from the North Sea, basically sets the stage for so much of the world's oil trade. So, if you're curious about how oil costs work and why Brent Crude is such a big deal, you're definitely in the right spot. We are going to cover all of that and more, giving you a clearer picture of this really important commodity.

Table of Contents

- What is Brent Crude Oil?

- Why Brent Crude Oil Matters Globally

- How Brent Crude Oil Prices Work

- Tracking the Brent Crude Oil Market

- Futures Contracts and Trading

- Recent Market Movements for Brent Crude

- Future Outlook for Brent Crude Oil

- Frequently Asked Questions About Brent Crude Oil

What is Brent Crude Oil?

Brent Crude Oil, you know, is a specific type of oil that comes out of the North Sea. It's not just any oil, though; it's, like, a really important kind of reference point, or benchmark, for figuring out oil costs all over the world. When you hear about the "price of oil" on the news, often, they are talking about Brent Crude. It is, basically, a light, sweet crude oil, which means it has a low sulfur content and is relatively easy to refine into products like gasoline and diesel. That's a pretty big deal for refiners, as a matter of fact.

This oil, which is sourced from, like, a few different oil fields in the North Sea, has become the main standard for oil that comes from Europe, Africa, and the Middle East. You see, when oil from these places is sold and shipped westward, its cost tends to be, more or less, set in relation to what Brent Crude is going for. It's, in a way, like a default setting for a huge chunk of the global oil supply. So, you know, its movements really tell us a lot about the bigger picture of oil costs.

It's pretty interesting, actually, how one particular type of oil can have such a wide-reaching effect. The quality of Brent Crude, its steady supply, and the way it's traded have all helped it become this kind of global reference. So, when people are talking about the "brent corrigan brent" price, they are very likely trying to find out about this specific, really important, North Sea oil. It's a key piece of the puzzle for anyone looking at energy markets, basically.

Why Brent Crude Oil Matters Globally

Brent Crude Oil matters, like, a whole lot, simply because it acts as a very, very big benchmark price for oil purchases around the world. Think of it, sort of, as a measuring stick. When countries or companies want to buy oil that comes from places like Europe, Africa, or the Middle East, they often look at the Brent Crude price to help them figure out what a fair cost should be. This is, you know, a pretty common practice in the oil business.

Because so much of the world's oil production, especially from those regions, tends to be priced relative to Brent, its cost movements have a really big ripple effect. If the Brent price goes up, then the cost of oil from, say, Nigeria or Saudi Arabia, that's headed west, will probably go up too. It's, like, a very interconnected system. This makes it a crucial indicator for the health of the global economy, in a way, and for energy security everywhere. It’s a kind of central point for a lot of oil deals.

Also, Brent Crude is very, very liquid, which means there are a lot of buyers and sellers for it. This makes its price a really good reflection of what's happening in the broader oil market. It's, you know, a transparent and widely accepted price, which helps make deals easier and fairer for everyone involved. So, when we talk about "brent corrigan brent" and its connection to oil, we are essentially talking about a fundamental piece of how the world buys and sells its energy. It's a big deal, definitely.

How Brent Crude Oil Prices Work

The cost of Brent Crude Oil, like any other commodity, is, basically, determined by the simple rules of supply and demand. If there's a lot of oil available and not as many people wanting to buy it, the cost will probably go down. But if there's, you know, less oil around and a lot of demand for it, the cost tends to go up. It's, in a way, that straightforward. Things like global economic growth, political events, and even weather patterns can all play a part in shifting that balance. It's a very dynamic situation, actually.

Live oil market costs are, you know, figured out through continuous trading on exchanges. People and companies are constantly buying and selling futures contracts, which are agreements to buy or sell oil at a certain cost on a future date. These trades happen all day long, reflecting every bit of new information that comes out. So, you know, the current cost you see for Brent Crude is a snapshot of all those trades happening right now. It's a real-time reflection of what the market thinks the oil is worth.

For example, if you look at the price of Brent Crude oil today, it might be, say, around $66.43 per barrel. This number is, essentially, the result of all those trades and all that market sentiment at that very moment. It's not just a random number; it's a very, very active reflection of what's going on in the world. So, when you are looking at "brent corrigan brent" in terms of its price, you are basically seeing the market's collective decision on its worth at that instant. It's a kind of constant negotiation, really.

Tracking the Brent Crude Oil Market

Keeping an eye on the Brent Crude Oil market is, you know, pretty easy these days with all the tools available. You can get instant access to the live Brent Crude Oil price, which is really helpful. There are, like, charts that show you how the cost has moved over time, and you can get real-time quotes. This kind of information is, basically, essential if you want to understand what's happening in the energy world. It's all about having the latest numbers, after all.

You can find all sorts of key market metrics, too, which give you a broader picture. This includes things like trading details, which tell you how much oil is being bought and sold, and intricate Brent Crude Oil futures contract specifications. Knowing these details can really help you, you know, get a deeper sense of the market's mood and direction. It's not just about the current cost; it's also about what people are expecting for the future. So, you know, it’s a bit more involved than just one number.

There are also, basically, lots of places to get news covering oil, petroleum, natural gas, and even investment advice related to energy. This helps you stay up-to-date on events that could affect the cost of Brent Crude. Live charts, historical data, and breaking news on Brent prices are, you know, readily available. For instance, you can find a complete Brent Crude Oil continuous contract futures overview by MarketWatch, which is pretty useful. It's all there, waiting for you to look at it, really.

Futures Contracts and Trading

When we talk about Brent Crude Oil, futures contracts are, like, a really big part of how it's bought and sold. A futures contract is, essentially, an agreement to buy or sell a specific amount of oil at a set cost on a particular date in the future. This is how a lot of the trading happens, you know, for commodities like oil. It allows producers to lock in a price for their future output and allows buyers to secure a future supply at a known cost. It's a way of managing risk, basically.

These contracts are traded on exchanges, and their costs are constantly moving based on, you know, what traders think will happen with supply and demand down the road. The data includes the latest futures prices in USD per barrel, reflecting global oil market movements throughout the trading day. So, if you see the "Brn00" symbol, that's, like, a complete Brent Crude Oil continuous contract futures overview. It's a very specific way of tracking the market's future expectations, actually.

Viewing the futures and commodity market news, futures pricing, and futures trading information is, you know, pretty important for anyone involved in this space. It's where the big money moves and where a lot of the price discovery happens. Understanding these contracts helps you see how the market is, more or less, forecasting future costs. So, when you look into "brent corrigan brent" and its connection to oil, you are definitely looking at a market that relies heavily on these kinds of agreements. They are a fundamental part of the system, really.

Recent Market Movements for Brent Crude

The cost of Brent Crude Oil, you know, can move quite a bit, even in a short time. For instance, the current cost of Brent Crude Oil today might be around $66.44 per barrel. That's, like, a very specific number for this moment. It's pretty common for it to go up or down, even just from one trading day to the next. This kind of movement is, basically, normal for a commodity that's so influenced by global events and economic news. It's a very active market, after all.

To give you an idea, the cost might be down by, say, 1.83% from the previous trading day. That's, you know, a noticeable shift. And if you look back a little further, in comparison to one week ago, when the cost might have been around $71.81 per barrel, Brent oil could be down by, like, 7.48%. These kinds of percentage changes show just how quickly the market can react to new information or changes in sentiment. It's a bit like a rollercoaster, sometimes.

These recent movements are, you know, really important for traders and analysts. They give clues about what might be driving the market right now. Whether it's news about oil production, changes in demand from big economies, or geopolitical tensions, all of these things can make the cost go up or down. So, when you hear about "brent corrigan brent" and its daily cost, you are, essentially, looking at the immediate impact of all those factors on the oil market. It's a very direct reflection, actually.

Future Outlook for Brent Crude Oil

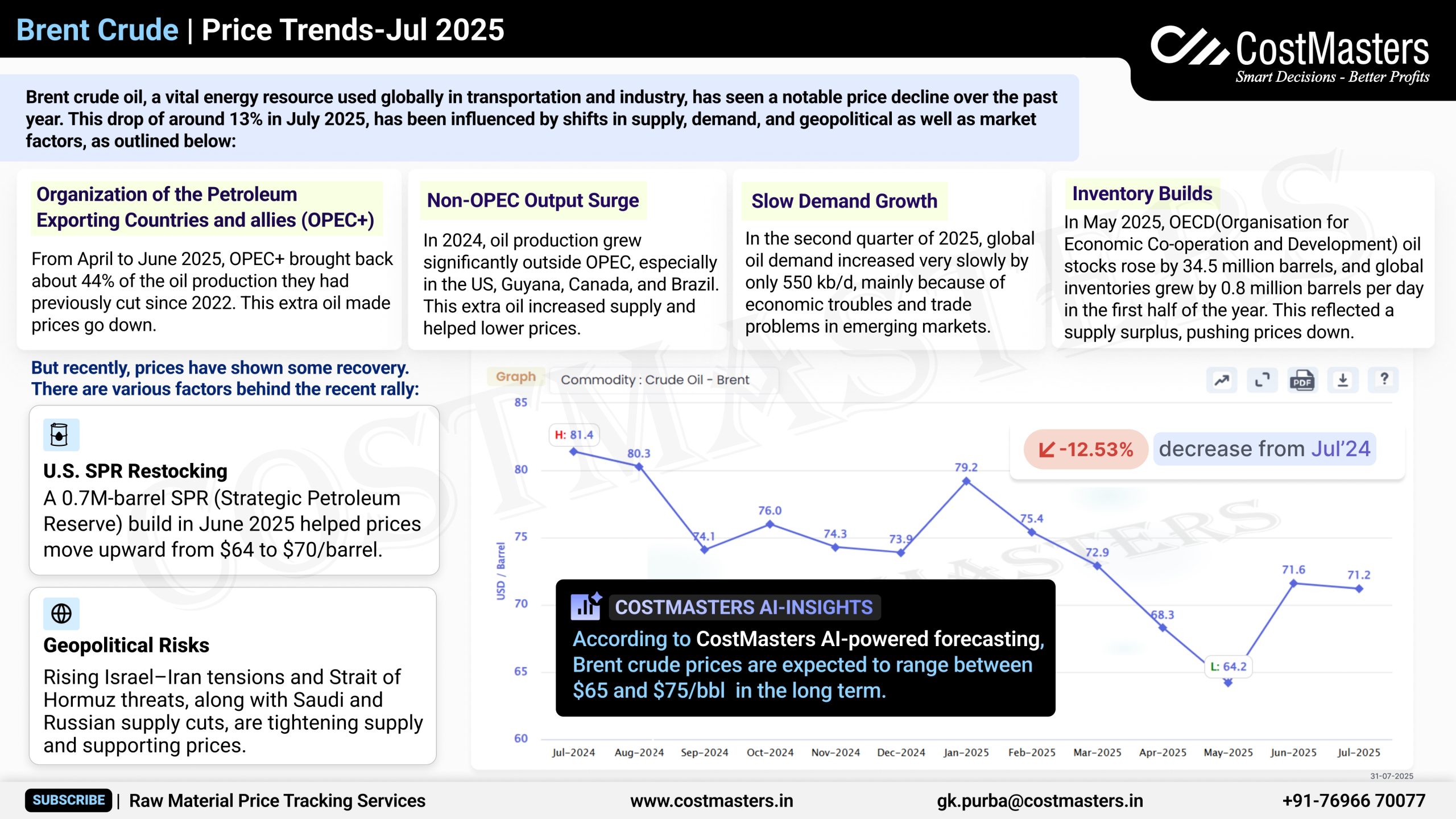

Looking ahead, you know, predicting the future cost of Brent Crude Oil is, like, a really big challenge, but experts do try to make educated guesses. For example, the Energy Information Administration (EIA) expects the Brent Crude Oil price to average less than $70 per barrel in 2025. That's, you know, a pretty specific forecast for the coming years. These kinds of predictions are based on a lot of things, like expected global economic growth, future oil supply, and even things like the adoption of cleaner energy sources. It's a very complex calculation, actually.

They also, you know, have a view for further out. The EIA, for instance, expects the cost to average about $58 per barrel in 2026. These numbers are, basically, estimates, and they can change as new information comes to light. But they give us a sense of what some of the major organizations are thinking about the long-term trends for oil. It's a kind of baseline for planning, really, for governments and businesses alike. So, you know, it’s not set in stone, but it’s a guide.

These outlooks are, you know, really important for long-term planning for energy companies and for countries that rely on oil. They help in making decisions about investments in new oil fields or in renewable energy. So, when you are thinking about "brent corrigan brent" in the context of future oil costs, you are really looking at how experts try to anticipate the balance of supply and demand years down the line. It's a fascinating area, in a way, trying to see what's coming next for such a vital commodity.

Frequently Asked Questions About Brent Crude Oil

What is Brent crude oil used for?

Brent Crude Oil, you know, is mainly used as a source for making various petroleum products. This includes, like, gasoline for cars, diesel for trucks and heavy machinery, and jet fuel for airplanes. It's also used to create heating oil and a range of petrochemicals, which are, basically, the building blocks for plastics and other industrial materials. So, it's pretty versatile, actually, once it's refined. It fuels a lot of daily life, in a way.

Why is Brent crude oil important?

Brent Crude Oil is, you know, really important because it serves as a major benchmark for pricing a huge portion of the world's oil. A lot of the oil produced in Europe, Africa, and the Middle East, especially when it's headed west, has its cost set in relation to Brent. So, its movements, you know, influence global energy costs and can affect economies worldwide. It's a kind of key indicator for the entire oil market, essentially.

How is Brent crude oil price determined?

The cost of Brent Crude Oil is, you know, determined by the forces of supply and demand on global commodity exchanges. Traders are constantly buying and selling futures contracts, and the latest news, economic data, and geopolitical events all influence their decisions. This continuous trading, basically, sets the live market cost. It's a very, very dynamic process, reflecting what the market thinks the oil is worth at any given moment, you know.

So, you know, we have covered quite a bit about what "brent corrigan brent" likely points to: the very important Brent Crude Oil. It's pretty clear, actually, how this particular type of oil plays a really big part in global energy. Understanding its cost, how it's traded, and what affects its movements can really help you make sense of the wider world of energy. It's a fundamental piece of information, basically, for anyone interested in global markets.

Gaining instant access to the live Brent Crude Oil price, key market metrics, and trading details is, you know, really valuable. It helps you stay informed about a commodity that affects so much of our daily lives. Whether you're interested in the current cost, historical data, or even, like, future predictions, knowing about Brent Crude gives you a solid foundation. You can learn more about Brent Crude Oil on our site, and you can also find more information on global energy markets here. It's all about staying informed, really.

Detail Author:

- Name : Dr. Declan Huels DVM

- Username : nolan.jesse

- Email : nels.bernhard@leannon.com

- Birthdate : 1997-07-23

- Address : 91859 Stan Green Apt. 201 South Geovany, WV 99902

- Phone : 754.896.5934

- Company : Zulauf-Roob

- Job : Special Education Teacher

- Bio : Eos provident possimus quia molestiae. Reprehenderit eveniet dolorum ut est rerum quos.

Socials

tiktok:

- url : https://tiktok.com/@maxie_dicki

- username : maxie_dicki

- bio : Similique dolor ipsa at nulla reiciendis eum.

- followers : 2370

- following : 107

linkedin:

- url : https://linkedin.com/in/maxie.dicki

- username : maxie.dicki

- bio : Tempora quo odit animi libero modi.

- followers : 4192

- following : 971

twitter:

- url : https://twitter.com/maxie9405

- username : maxie9405

- bio : Sequi voluptas cupiditate cum ducimus enim. Dolorem recusandae quas voluptas ducimus nihil. Dolorem expedita reprehenderit porro doloremque quasi fugit qui.

- followers : 4313

- following : 1247